Canadian Design and Construction Report staff writer

New home sales in the Greater Toronto Area remained at historic lows in May, sparking urgent warnings from the building industry about the threat of massive construction job losses and a severe drop in housing starts.

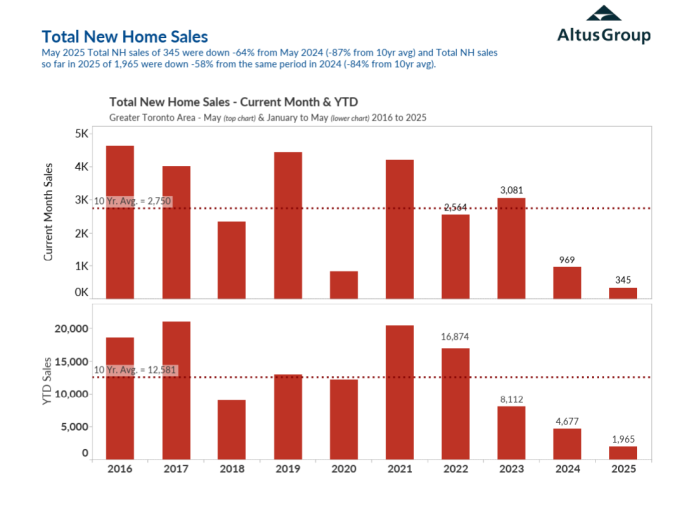

Only 345 new homes were sold across the region last month, down 64 per cent from May 2024 and 87 per cent below the 10-year average of 2,749 units, according to data from Altus Group. It was the eighth consecutive month of record-setting lows for the GTA’s new home market.

“May 2025 new home sales across the GTA remained at rock bottom levels,” said Edward Jegg, research manager at Altus Group. “Market conditions definitely are in the buyer’s favour right now; they just need the confidence to move ahead with their purchase.”

Sales were weak across both major housing types. Only 137 condominium apartments were sold, down 74 per cent year-over-year and 93 per cent below the 10-year average. Single-family home sales totalled 208, down 53 per cent from last year and 74 per cent below the norm.

The deepening slump has prompted alarm from the Building Industry and Land Development Association (BILD) and the Ontario Home Builders’ Association (OHBA), which commissioned an economic analysis projecting a 60 per cent drop in housing starts by 2027 compared to 2024 levels.

That drop, they warn, could eliminate 41,000 residential construction jobs in the GTA and wipe out $10 billion in annual construction investment.

“The pipeline of future housing supply for the GTA is at risk,” said BILD president and CEO Dave Wilkes. “This isn’t just about housing — it’s about protecting jobs and economic activity in our region.”

The industry is urging the federal and provincial governments to immediately eliminate GST and HST on all new homes. A separate study by the Missing Middle Initiative estimates the cost of such a measure at $2 billion nationally and $900 million in Ontario.

“This one measure taken in tandem by the province and federal government can immediately lower housing costs, jump-start demand, and protect against future supply shocks that spike prices,” said OHBA CEO Scott Andison. “If this were any other industrial sector, this wouldn’t even be a question.”

Alongside tax relief, industry leaders are calling for a reduction in development charges and other municipal and provincial fees they say are pushing new home prices out of reach and making projects financially unfeasible.

“The current cost-to-build crisis is real, it’s here now, and it will have very negative impacts on the economy and municipalities of the GTA,” said Justin Sherwood, BILD’s senior vice-president of communications, research and stakeholder relations.

New home inventory in the GTA rose slightly in May to 21,571 units, including 16,384 condo apartments and 5,187 single-family homes — representing about 17 months of supply at current sales rates.

Benchmark prices also declined. The average price of a new condo fell 2.2 per cent year-over-year to $1,021,339, while the price of a single-family home dropped 6.6 per cent to $1,505,539.

“Without coordinated government action, we are on track for a prolonged slowdown that threatens jobs, investment, and housing affordability,” Wilkes said.