Canadian Design and Construction Report staff writer

The slowdown in housing construction across the Greater Toronto Area and Greater Golden Horseshoe is taking a heavy toll on employment, according to a new analysis by the Missing Middle Initiative.

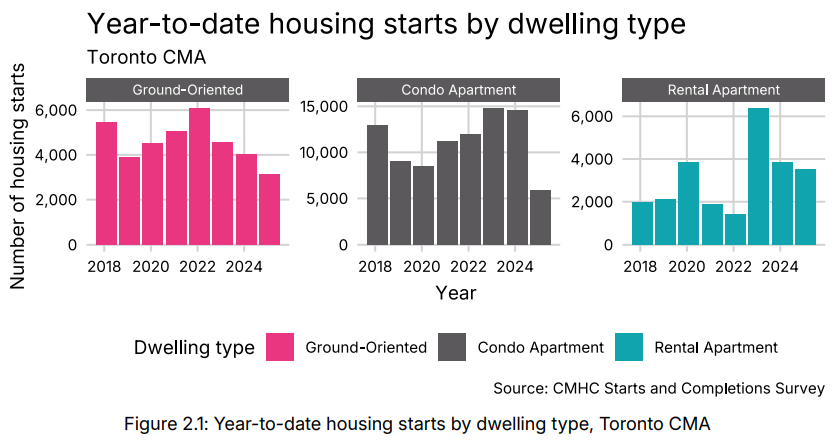

Housing starts in the first six months of 2025 fell 40 per cent compared with the average of the same period over the previous four years. Condo apartment starts were down 54 per cent, and ground-oriented housing — including single-family homes and townhouses — fell 42 per cent. Purpose-built rental starts rose modestly, by 8 per cent.

“Unfortunately, things are going to get worse before they get better. Housing starts are a lagging indicator, as the CMHC only considers a unit to be “started” when a building’s foundation is 100% complete, so it often reflects the market decisions of several years prior, when the decision to build was made,” the report states. “Pre-construction housing sales are a better indicator of the market’s current health and are indicative of future housing starts.”

“Unfortunately, things are going to get worse before they get better. Housing starts are a lagging indicator, as the CMHC only considers a unit to be “started” when a building’s foundation is 100% complete, so it often reflects the market decisions of several years prior, when the decision to build was made,” the report states. “Pre-construction housing sales are a better indicator of the market’s current health and are indicative of future housing starts.”

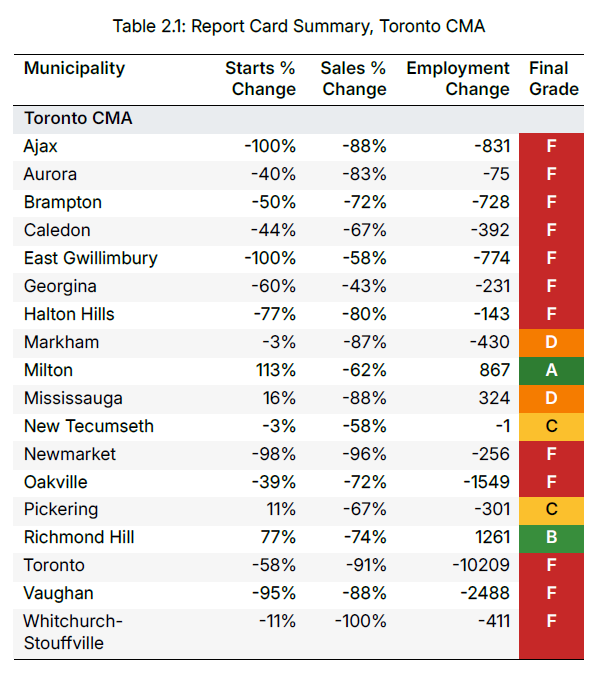

The decline has direct consequences for construction employment. Building a ground-oriented home typically requires 3.8 years of labour, while an apartment unit requires 1.5 years. The report estimates that the drop in starts so far this year represents a loss of 24,195 person-years of employment across the region.

In Toronto, the decline in housing starts, compared to the previous four-year average at this point in the year, is estimated to have reduced the number of construction jobs: Toronto (down 10,209. In Mississauga, in contrast, 324 jobs have been added, largely driven by much higher starts of rental apartments.

In Toronto, the decline in housing starts, compared to the previous four-year average at this point in the year, is estimated to have reduced the number of construction jobs: Toronto (down 10,209. In Mississauga, in contrast, 324 jobs have been added, largely driven by much higher starts of rental apartments.

Pre-construction sales, a leading indicator of future building activity, are even weaker. Condo pre-sales fell 89 per cent, and ground-oriented pre-sales dropped 70 per cent, suggesting the market may continue to weaken before recovery.

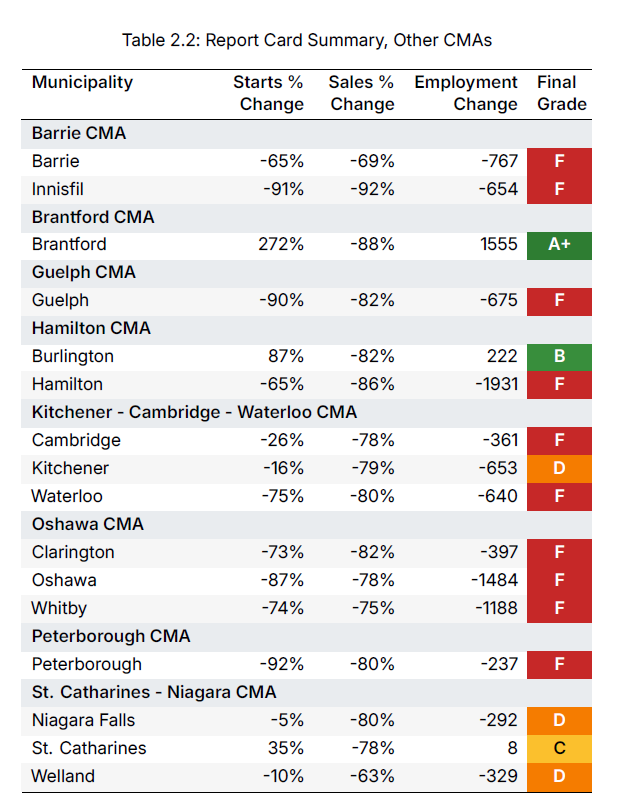

Of the 34 municipalities analyzed, 22 received failing grades for housing performance, with only seven scoring a C or higher — mostly due to strong past starts rather than current market demand.

Of the 34 municipalities analyzed, 22 received failing grades for housing performance, with only seven scoring a C or higher — mostly due to strong past starts rather than current market demand.

The report underscores that the housing slowdown is not limited to the condo market and highlights the urgent need for coordinated policy action to support both construction activity and employment in Ontario’s largest urban regions.