Canadian Design and Construction Report staff writer

Sentiment in Canada’s construction industry has turned negative for the first time in 2025, as the sector grapples with rising costs, tight financing, and a sharp decline in commercial workloads, according to a new report released Wednesday.

The Q3 2025 Canada Construction Monitor, published by the Royal Institution of Chartered Surveyors (RICS) and the Canadian Institute of Quantity Surveyors (CIQS), paints a picture of a distinct “two-speed” market: while infrastructure projects remain resilient, the private sector is facing significant headwinds.

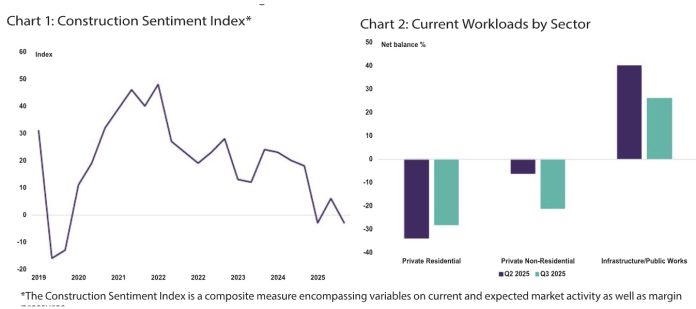

The report’s Construction Sentiment Index (CSI)—a composite measure of current and expected market activity—dropped to a reading of -3 in the third quarter, down from +6 in the previous quarter.

“The Q3 survey reveals that the Canadian construction sector sits at a critical turning point, where industry confidence is declining despite continued strong infrastructure activity,” said Sheila Lennon, Chief Executive Officer of CIQS.

Private sector drags down momentum

The downturn was driven primarily by weakness in private sector activity. While the decline in private residential workloads eased slightly, improving from a net balance of -34 per cent to -28 per cent, the sector remains deep in contraction territory.

More alarmingly, private non-residential activity deteriorated sharply. The net balance for commercial workloads fell from -6 per cent in Q2 to -21 per cent in Q3, signalling a notable drop in momentum for office and retail projects.

In contrast, the infrastructure and public works sector continues to outperform, posting a positive net balance of +26 per cent. However, even this bright spot is showing signs of cooling; the reading is down from +40 per cent in the previous quarter. While transport projects remain steady, growth in energy and ICT (Information and Communication Technology) infrastructure has moderated.

Financial and regulatory hurdles intensify

Survey respondents pointed to an “intensification” of financial pressures as a primary driver of the slowdown. Sixty per cent of respondents cited financial constraints as a major impediment to building, up from 50 per cent in the second quarter.

Additionally, 63 per cent of respondents reported rising material costs, an increase from 59 per cent in the previous quarter. The report suggests these challenges reflect the combined impact of elevated interest rates and recently introduced tariff schedules.

In the survey’s feedback section, industry professionals across Ontario highlighted specific regulatory and economic barriers.

“The USA/Canada Trade Tariffs and CUSMA Free Trade negotiations are negatively impacting Canada’s economy,” noted a respondent from Cambridge..

In Toronto, respondents pointed to a “macro-economic slow down” and issues with the “timing of municipal approvals” as key factors hindering projects. Another Toronto-based participant noted that “past sales and design practices have seriously affected the residential market,” suggesting that an investor-speculator model was “not sustainable”.

Looking ahead

The industry’s outlook for the next 12 months has turned cautious. While expectations for infrastructure workloads remain positive at +38 per cent, projections for both private residential (-3 per cent) and non-residential (-6 per cent) sectors have slipped into negative territory.

Profitability is a major concern. Expectations for profit margins dropped to a net balance of -9 per cent, down from a flat reading of zero in Q2. Consequently, hiring intentions have softened, with employment growth expectations falling from +17 per cent to +5 per cent.

“Construction firms are challenged by financial constraints, persistent labour shortages, and rising material costs,” Lennon said.

“While the government’s strong commitment to infrastructure spending in the Fall Budget should theoretically drive industry growth, the true test will be whether that investment is enough to overcome those challenges to deliver real, meaningful impact moving forward.”

Despite the cooling demand, the industry continues to face structural labour challenges. Sixty-two per cent of respondents identified skills shortages as a constraint, up from 56 per cent in the previous quarter.