Canadian Design and Construction Report staff writer

Canada’s 2025 federal budget is getting two thumbs up from construction‑industry groups as a significant step toward accelerating both major infrastructure projects and new housing construction.

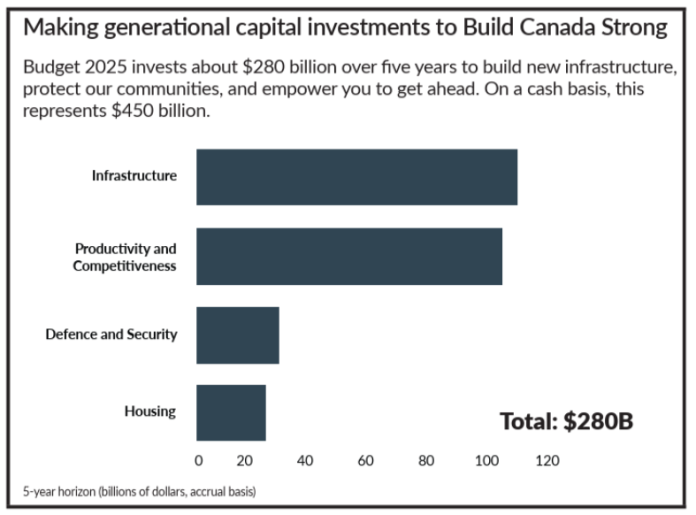

The Progressive Contractors Association of Canada (PCA) welcomed this year’s budget—titled “Canada Strong”—for its commitment to infrastructure and economic growth. The budget dedicates approximately $280 billion over five years to nation‑building investments including:

- $115 billion is earmarked for infrastructure over five years.

- $110 billion goes to productivity and competitiveness initiatives.

Additional major allocations include defence, housing, and climate/clean‑growth investments.

A key feature is the newly announced Build Communities Strong Fund, a $50‑billion, 10‑year commitment for local infrastructure projects such as transit, sewage/water systems, and roads.

“The question now is how Canada’s project‑approval process will become more efficient and predictable,” said Paul de Jong, President & CEO of PCA. “After a decade of stalled and cancelled projects, we’re pleased this budget is focused on infrastructure spending, accelerating projects and boosting investor confidence.”

The Residential Construction Council of Ontario (RESCON) also welcomed the housing‑related measures. Among the federal announcements: elimination of the GST on new homes priced at or under $1 million for first‑time buyers, and a reduced GST on homes up to $1.5 million for that category.

“First‑time buyers represent a substantial segment of the market, and we are already seeing increased traffic at sales centres,” said RESCON President Richard Lyall, clarifying the combined federal‑provincial tax cuts will amount to about 13 per cent cost reduction for first‑time buyers or about $130,000 on a $1 million home.

“The tax burden on new housing is one of the critical factors stymieing new construction and driving up costs,” he said. “Presently, the tax burden accounts for 36 per cent of the cost of a new home. The best way to improve housing affordability is to prioritise lowering costs via reducing the tax burden.”

In addition, Lyall pointed to the budget’s commitment to the Build Canada Homes initiative, which is expected to create new pathways for major home‑building.

Both construction industry leaders emphasised that the budget’s infrastructure and housing measures could help get critical projects and homes built—at a time when Ontario faces its most severe housing crisis in a generation.

However, the implementation phase will be key because without a more streamlined approval process and more predictable procurement/tendering, the funding may not translate into timely builds.

Also, tax relief “must be paired with removing regulatory and cost‑barriers” such as high levies, development charges and zoning delays) to convert the investment into actual housing units.

“The federal government must ensure there are no labour provisions that restrict who can bid on and construct nation‑building projects. All talented contractors and workers should get a shot at building projects that make Canada stronger,” de Jong said.

Lyall added: “It is critical that we get this right … bold action is necessary.”