The cost of building a home in Canada has never been higher. That’s the conclusion in Proof Point: Soaring construction costs will hamper Canada’s homebuilding ambitions, a report on industry costs released by RBC this week.

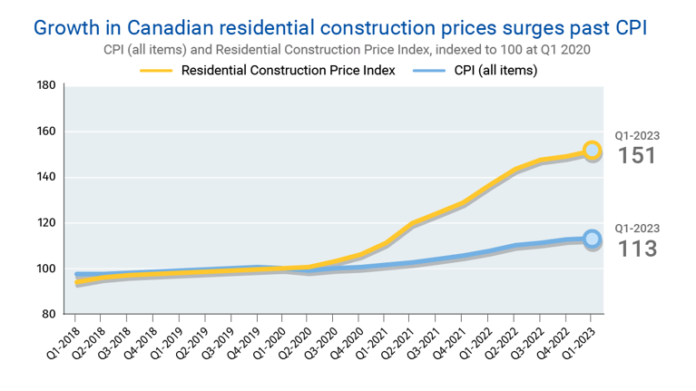

Up 51 per cent since the start of the pandemic, the country’s residential construction price index has well outpaced Consumer Price Index (+13 per cent). Driving the increase are dramatic jumps in prices for key building materials like concrete and structural steel, up 55% and 53% respectively since the first quarter of 2020. Soaring lumber prices in 2021 and early 2022 also drove up costs but have since retreated.

This surge in raw material prices, together with a ballooning population, has accelerated increases in the development fees and levies imposed by municipal governments. These fast-growing fees—which increased as much as 30% annually last year for single or semi-detached units—are indexed to Statistics Canada’s Construction Cost Index. Given they are intended to fund the growth component of municipal capital projects, high levels of expected population growth, alongside inflation, have contributed to the rapid acceleration of these fees.

The report points to a shortage of workers in the skilled trades that is impacting costs.

“Longer-range problems will continue to challenge efforts to expand Canada’s housing stock. Amid construction material supply constraints, governments will need to keep policy in line with the broader goal of improving housing affordability,” the report states, adding more housing starts are required to deliver a badly needed expansion in housing supply, but will boost demand for materials, which will put upward pressure on costs once again.

Also, higher input costs (such as fuel and transportation) have disrupted production, while robust demand and a shortage of workers have created serious imbalances in the jobs market. Labour costs have soared as high vacancy rates in construction exceed overall rates. High vacancy rates in construction jobs have exceeded overall vacancy rates since at least Q4 2020—and sent labour costs soaring. Wages in the sector grew 9.4% in 2022, nearly double the pace of other industries.

“Reining in construction costs to deliver more affordable and attainable housing won’t be easy,” the report states. “In the near-term, a lull in homebuilding and the resolution of production issues at cement plants are likely to ease the pressure to some degree. We expect housing starts to dip 10 per cent this year across Canada, which should temporarily soften demand for materials.”

However, RBC is warning that significantly ramping up homebuilding over the medium to longer term will keep costs elevated and continuing to focus on higher-density development in very tall structures will push up demand for cement—potentially straining production capacity limits – a difficult problem to solve given the environmental impact of ramping up production.